How to Make a Personal Finance App

- What is a Finance App and Why do People Need Them

- Types of personal finance apps

- How a Personal Finance App Makes Money

- A personal finance app vs. Covid 19

- What is the Best Personal Finance App

- How to Create a Budgeting App that People will Want to Use

- Trends in personal finance app development

- Psychology of personal finance management

- What people expect from a money management app

- Personal Finance Management Mobile App Development

- App development process: a step-by-step guide

- Outcomes

Among the many different applications, games have been the undisputed market leaders for several years. However, this does not mean that smartphone owners prefer only to have fun. According to Google, back in 2016, 73% of smartphone users used at least one finance management app. And already AppsFlyer pointed to a 354% growth in the popularity of personal finance apps in the 5 years from 2014 to 2019.

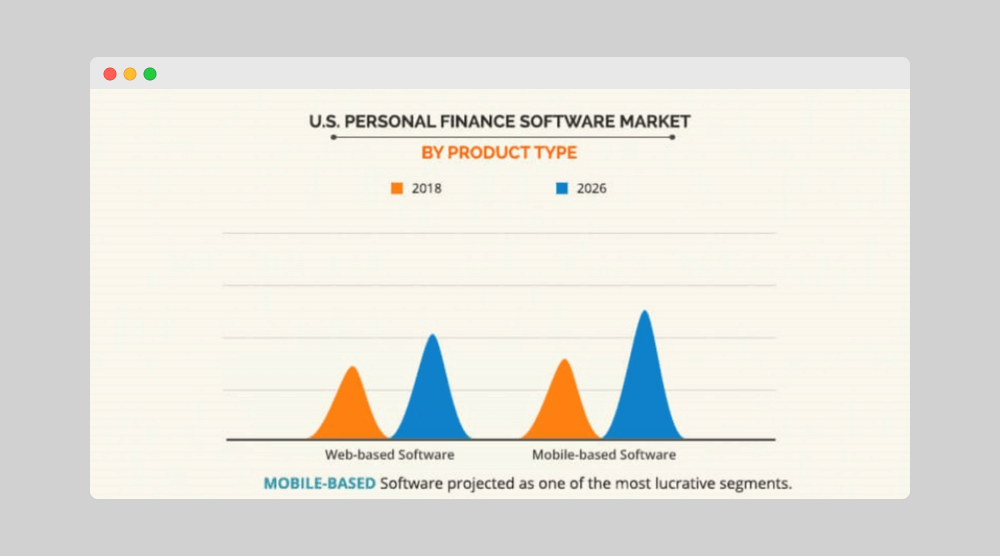

In addition, the emphasis is on the fact that it is mobile applications, not web versions, that are now a more promising segment. According to Allied Market Research the U.S. personal finance software market size was valued at $232 million in 2018 and is expected to reach $343 million by 2026, registering a CAGR of 5% from 2019 to 2026.

What is a Finance App and Why do People Need Them

Al finance app, also known as money management or budget app, is a mobile personal income/expense tracking application with a variable functions set that allow you not only to control personal spends, but also advise where to invest. So the user can not only save, but also earn.

All accounts, bank cards, e-wallets, and other money custodians are collected in one place. The information is systematized, analyzed, and the user observes his/her expenses on charts and diagrams ad oculos. If the first created financial apps required a person to contribute all their income and expenses, everything could be done automatically. Every cup of coffee and every donut counts – they shall not pass! However, manual versions of money management apps are still in demand. Financial apps help:

- Take control of your spending

- Save money for a substantial purchase

- Collect an amount for a rainy day

- Deal with tax charges

- Get out of debt with the least losses

The same Google statistics suggest that users abandon half of the applications because they find something more interesting, suitable in functionality, and meeting current needs. On average, users who decide to control their finances tend to download 2-3 apps because they cannot find all the functions they need in one place. Is this not a reason to create the “perfect” application for your target audience? And The APP Solutions can meet this challenge.

Types of personal finance apps

As we have already mentioned above, most often, budgeting apps are divided into two types:

- Manual (simple)

- Automatic (complex)

In the first case, all data is entered by the user himself. In the second, electronic transactions provide such information to the personal finance app.

The advantage of manual budgeting apps can be called a “psychological” moment at which the person driving all the expenses realizes that some of them could have been avoided. Accordingly, he/her has a better idea of what to save on and where to fork out. Such applications are more secure in terms of security. Plus, their interface is much simpler. Among the minuses is the human factor. The user can not only make a mistake when entering data, but also banally forget to enter something.

In contrast, automatic management apps do not forget anything (unless the payment was made in cash and is not registered) and save time. Security issues can arise, but if you invest in good cyber defense, nothing will happen.

Accordingly, the first type of personal finance app is much easier and cheaper to develop. But in the future, the second may be more advantageous due to broader functionality.

Note that fintech applications also include:

- Peer to Peer Payments App

- Full-Service Banking App

- Money Investment Management App

- Financial Management Software

- Bookkeeping Software

- Financial Forecasting Apps

However, here we will be talking solely about personal money management apps.

How Does Blockchain Amplify Adtech Industry

How a Personal Finance App Makes Money

How can you earn money on a finance app? Well, the most obvious way is to pay for it, invite potential customers to get a monthly or yearly subscription. However, for users to understand what they are paying for, they need to be given a trial period or make the basic set of features free for all time – the so-called freemium model.

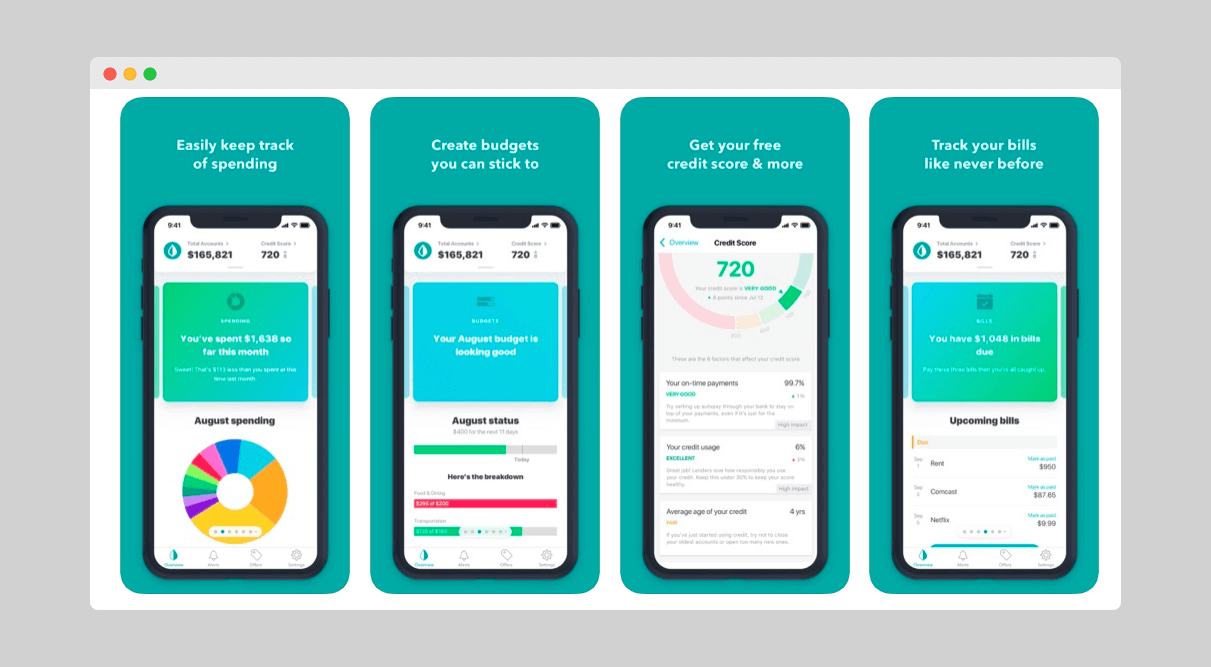

For example, one of the most popular personal finance apps in the world, Mint, is available for free, but for a fee, you will receive, not only a set of more advanced features, but also personalized offers. The AI of the application, based on the financial situation, makes calculations and, based on them, offers the most relevant investments, loans, credit cards and types of savings that would ideally suit a particular user. And U.S. users for a separate monthly subscription get the opportunity to communicate with a live financial advisor.

Another easy way to make money on a financial application is an affiliate program (advertising, which can be turned off for a nominal fee).

A personal finance app vs. Covid 19

Deprived of the opportunity to spend money offline for a long time, confused people worldwide have reduced their spending. However, now, when the market is slowly recovering and people are happy to leave their homes, the mood to spend what they have not spent encourages impulsive purchases. To control themselves, many users download personal finance apps.

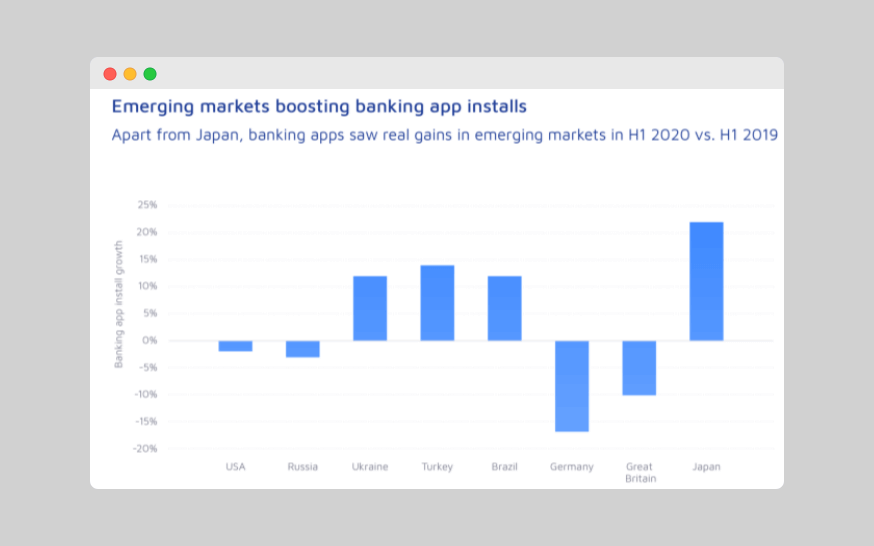

Even without the peak of Covid restrictions in 2019-2020, the Asian market grew significantly – weekly use of fintech applications in Japan grew by 55% between December 29, 2019, and March 1, 2020. Whereas in Western Europe and the United States (only 20%), money management applications were used less often. In France and Spain, the growth was zero.

This suggests that emerging markets are more promising for budget mobile apps. So, among the attractive countries, Apptopia analysts named Brazil, Turkey, and Ukraine. That is, countries where the general level of financial literacy of the population and its training in educational institutions leaves much to be desired, which causes users to need money management apps.

What is the Best Personal Finance App

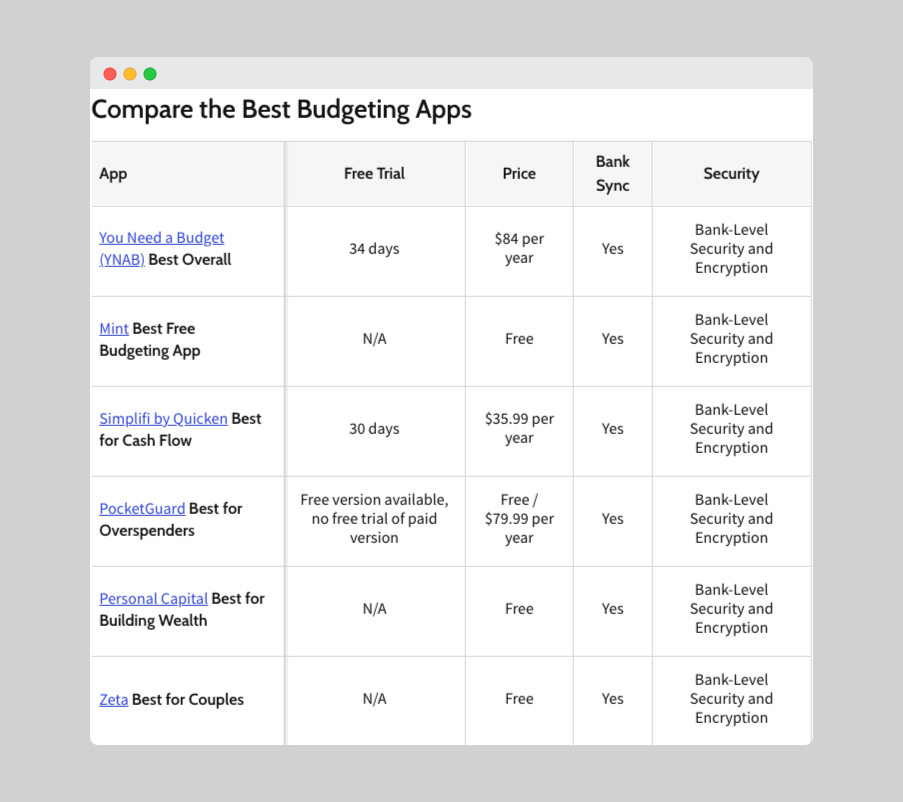

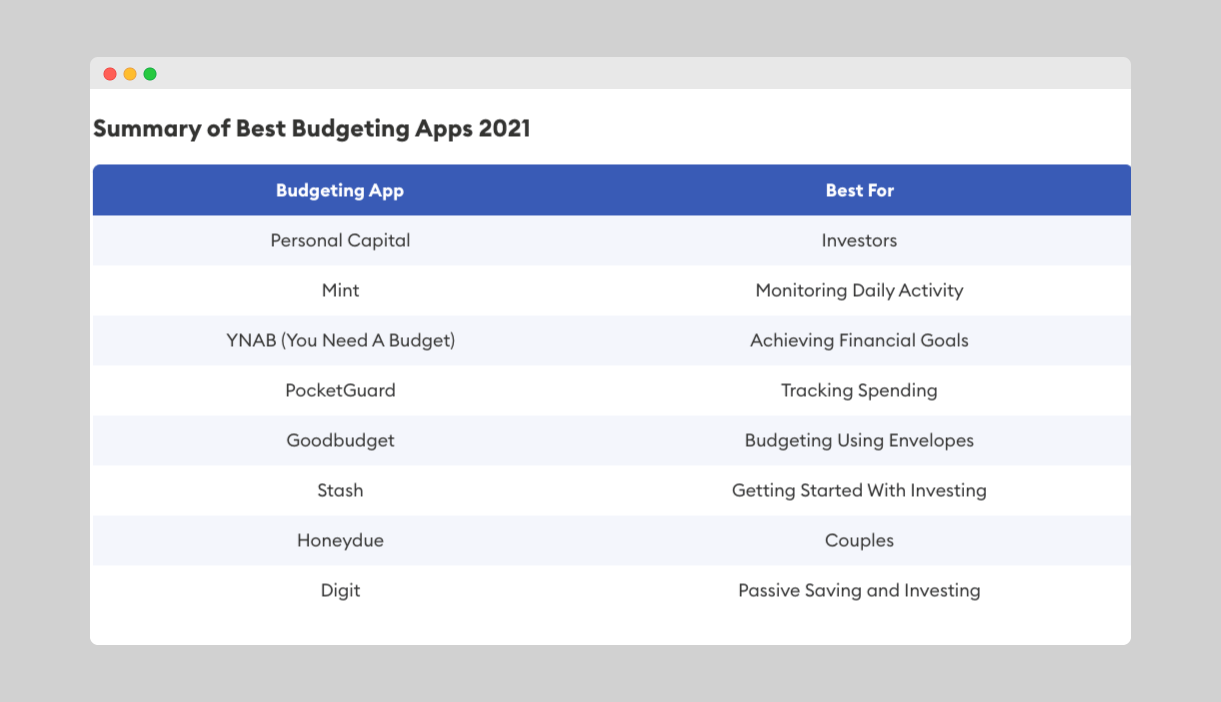

According to Investopedia, the best financial mobile apps at the moment are:

At the same time, in addition to the budget management apps listed above, Forbes advises Personal Capital, Good Budget, Stash, Honeydue, Digit… All of them received a score of 3.5 out of 5 and higher. Each personal finance app has its own strengths.

How to Create a Budgeting App that People will Want to Use

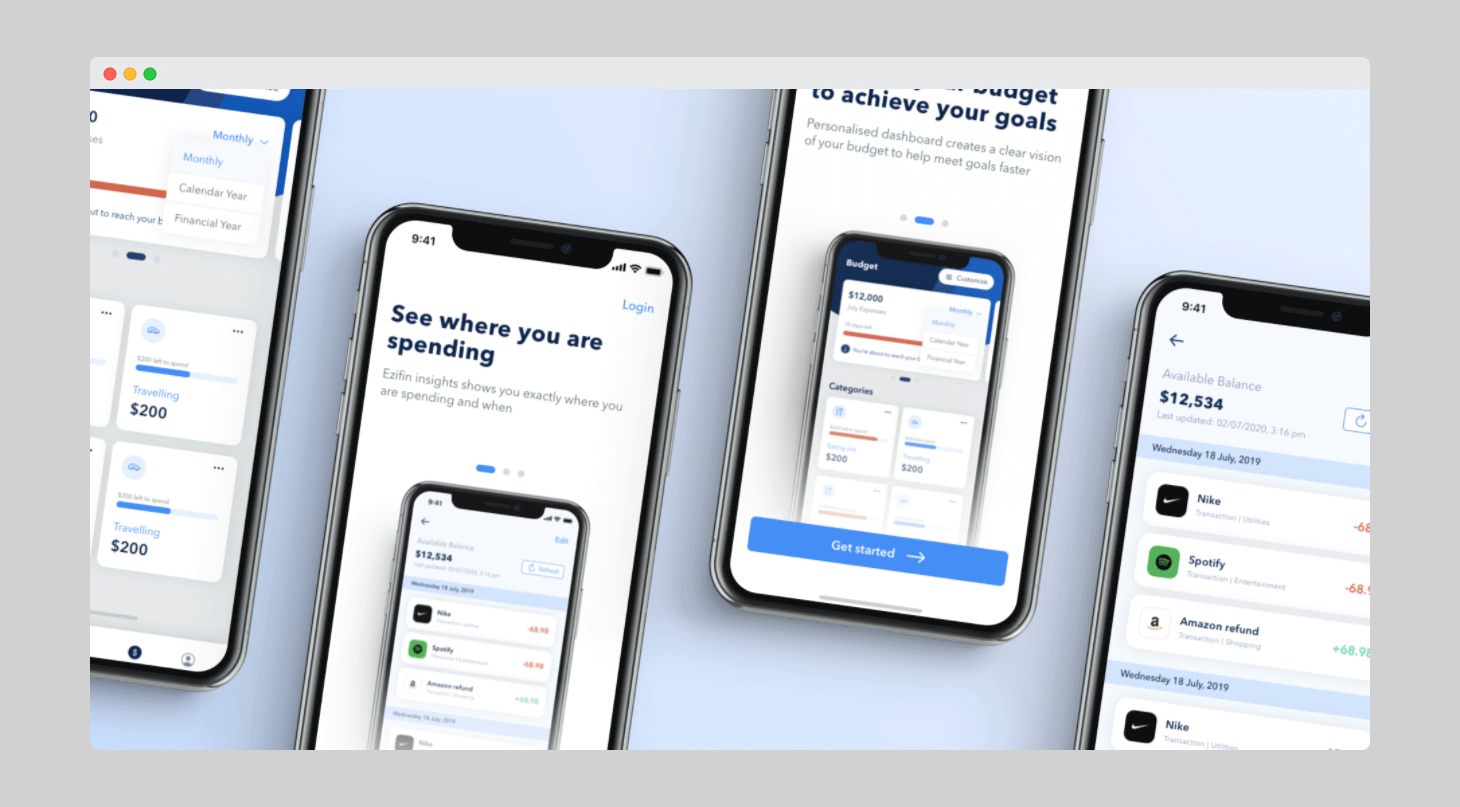

What do users want to see in the perfect finance app? In fact, many of them initially don’t even know what they want. They just download the apps recommended by friends or ratings and see how easy or difficult it is to figure out how to use it, exclaiming along the way: “Oh, this is an interesting thing, I didn’t even think it was possible. Well, I’ll use it.”

Remember that finance isn’t always a deeply personal, intimate topic. Many couples have all their accounts in common. Also, a lot of parents want to teach children from an early age financial literacy through gadgets, because in the digital era, not textbooks, but smartphone screens for children have become the best teachers.

So, when developing a concept it is best to contact competitors who are already working with your target audience. Your money management app should balance between information content and simplicity that won’t scare an uninformed user the first time they open it. Keep in mind that a financial application must meet these criteria:

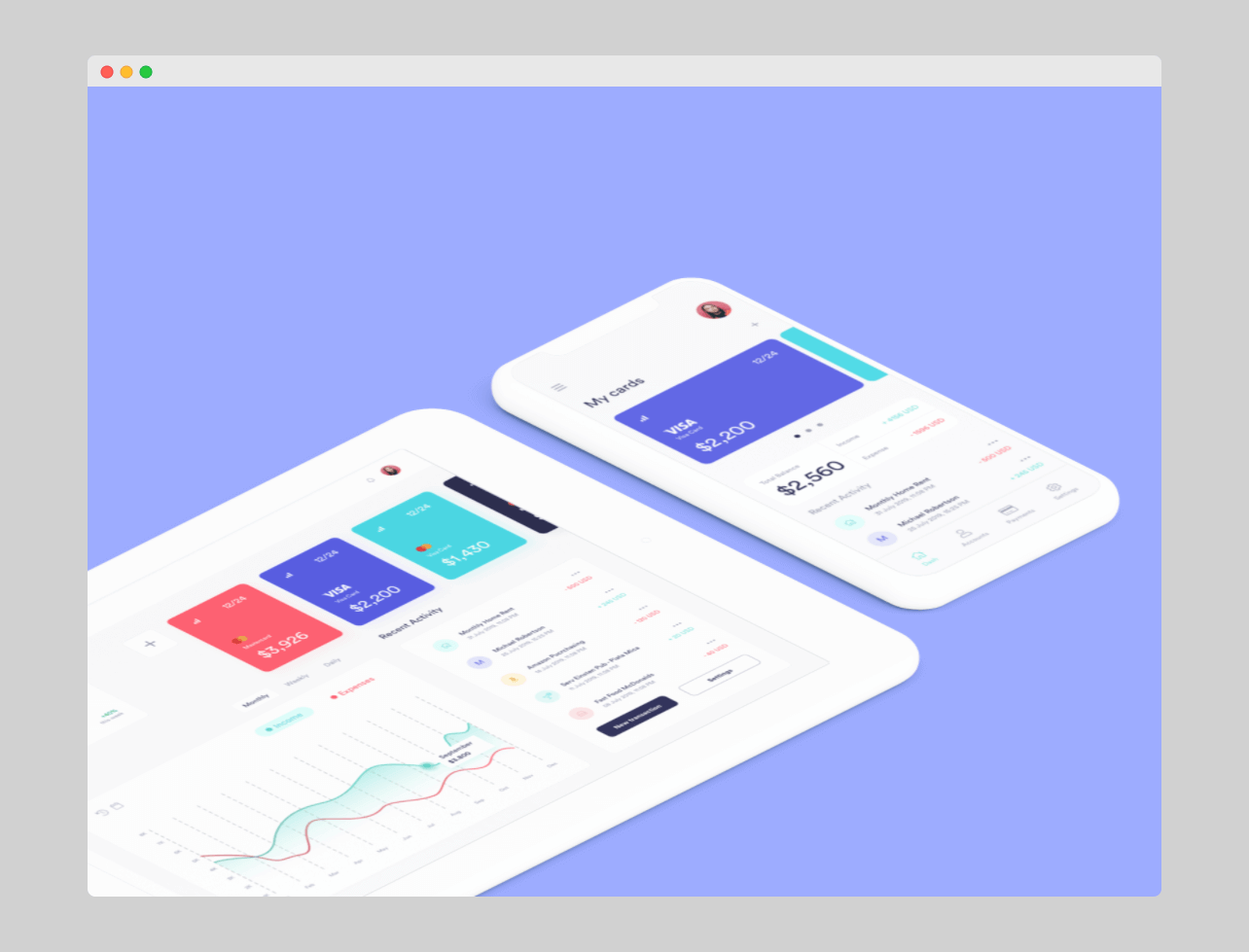

- Minimalistic interface. Study your audience. Your task is to ensure that any option in the personal finance app is within a 3-step accessibility maximum. Make the home page as simple as possible, and at the same time, visually attractive so that there is a desire to download your budgeting app from the first screen.

- Comprehensibility. Each hierarchy should be logically built. Each schedule should be clearly substantiated. The financial due diligence process should be as fast and straightforward as possible since people use financial applications on the run.

- Micro animation. It helps to better explain what you want to focus the user’s attention on. Various buttons, sliders, dynamic charts, and other interactive elements, help to show more clearly the success and gaps in a person’s budgeting.

Separately, we’d like to note how important two-way communication with the client is. If your finance app has technical support (even if not round-the-clock, and in a chatbot-form), this will significantly elevate you over competitors.

What You’re Paying For Or How Ads.Txt Helps To Fight Adtech Fraud

Trends in personal finance app development

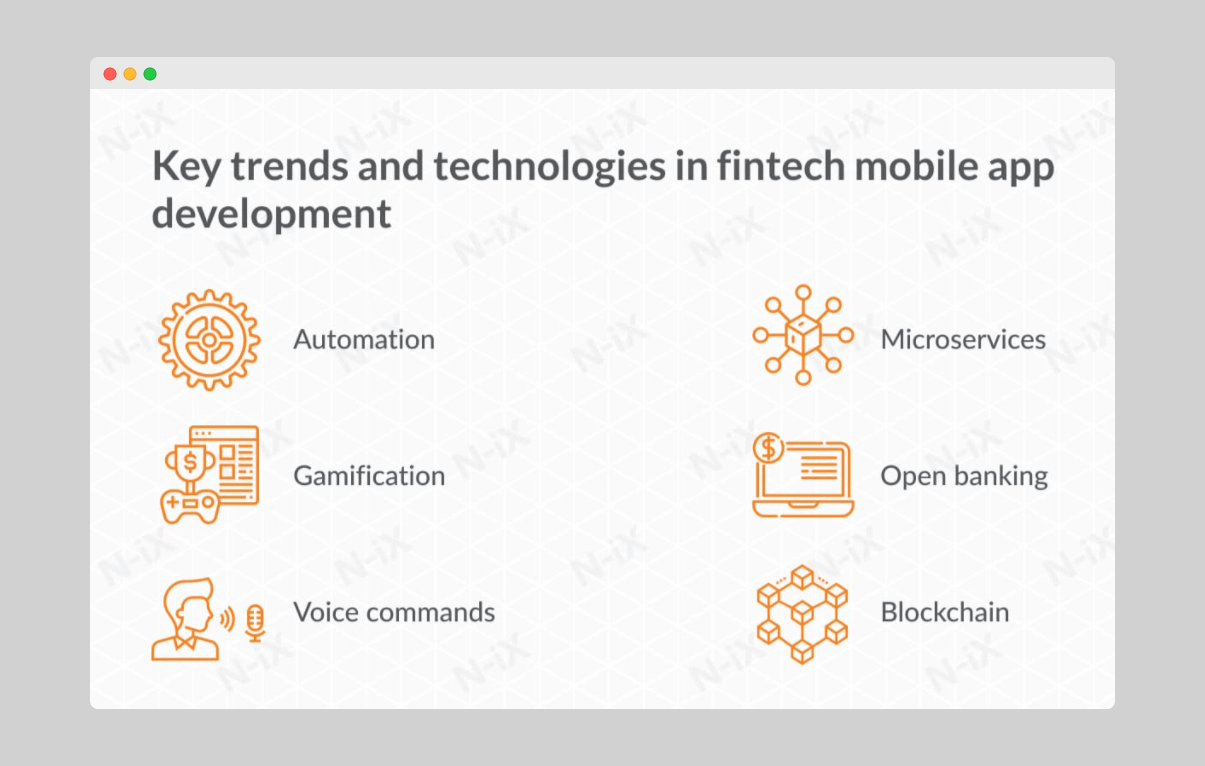

In addition to the standard set of options found in every second budget app, it is very important to keep up with the times and try to win with attractive features that will make your budget application even more attractive.

Consider implementing artificial intelligence first. Algorithms will help the application form personal advice for users: indicate excessive spending, suggest how best to manage the rest of the monthly budget, advise how to build your budget in accordance with the goals of each specific user…

Another important point that a wide variety of personal finance apps have increasingly begun to implement is voice commands. Agree that voicing your expenses and the categories you need at the moment is much faster than typing them.

The easiest way to achieve the maximum simplicity of the money management app mentioned above is to place the expense history on the main page. In the overwhelming majority of cases, this is exactly what users come for, so now it has become a trend among budget apps.

Do not offer users a simple cost calculator – often, these are people who have no idea how to save their money. Instead, give them a clear outline that will allow them to streamline their spending, see their gaps, and correct mistakes from the very first month of using the budgeting app.

Finally, to attract as many users as possible to your side, introduce an element of gamification so that the boring practice of balancing an account will become an extraordinary incentive for the user. Reward the user for fulfilling the plan on a monthly budget, help the user playfully achieve the desired result:

- Add the option to “compete” with family and friends

- Make an attractive visualization of savings growth so that the user can literally feel and see the increase in their income

- Add a strategy element to the application.

For example, personal finance apps like Nestlings and Fortune City may entice you to make smart financial moves to advance your virtual characters’ storylines. If this approach is made correctly, the application is bound to succeed!

How To Choose Best Payment Gateway For eCommerce

Psychology of personal finance management

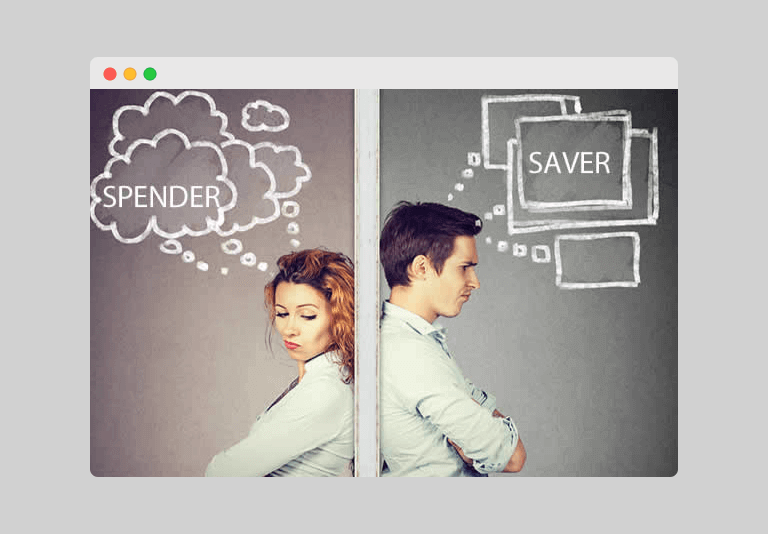

For the target audience to hire us for jobs to be done, you need to understand what an ordinary user expects from personal finance applications. There are two main groups among users of budgeting apps.

- Spenders

- Savers

Those who cannot control their budget without help, and those who know how to distribute their expenses correctly, like to track the dynamics of cash receipts and spending visually.

As practice shows, it is better not to be limited to one of these two groups but to work with both at once. Help spenders keep their money within limits so that they don’t exceed their salary. And show savers what useful things they can do with their saved money. Debt is bad. Emergency funds are good. Overdrawing your account is bad. Earning interest on your savings is good.

With a set of useful options and minimalistic design, you should be able to catch even people who are not interested in financial applications, who are scrolling through Apple Store or Google Play Market in search of useful applications.

What people expect from a money management app

In order that your budget app is wanted to be downloaded and not abandoned after the second entry, you should focus on the user’s needs, both in form and in content. An application should not only keep up with the times in terms of technology and UX/UI design but also offer users the options they need, including:

- Simple authorization and personal account without redundant functions

- Ability to bind to bank cards, integration with banks, scan checks

- Transactions history, as well as their tracking, viewing balances on accounts and cards

- Limit on spending – per day/week/month

- Categorization of expenses for food, clothing, rent, taxi, household appliances, unplanned expenses

- All conceivable and inconceivable reports and statistics in dynamics (comparison of spending with other family members or a certain product in different stores)

- Setting goals and tracking progress

- Tips on financial literacy, such as how to save up for a large purchase

- Reminder about paying taxes, fees, fines, etc.

- Standard features of any fintech app: calculator, currency converter, exchange/cryptocurrency indices, regular payments calendar, etc.

- Payment templates

- Search

- Backup (is a must!)

But the most important thing is safety. According to Google statistics, 30% of financial applications succumbed to hacker attacks. In this regard, always build budgeting apps with a secure cloud infrastructure, conduct penetration testing and security audits. When building a personal finance app it’s important to pay attention to PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation). And, of course, choose trusted developers to collaborate with.

Pros And Cons Of Bootstrap And Investment Funding

Personal Finance Management Mobile App Development

First, you need to understand what kind of team you need to develop a financial application. This usually includes:

- Project manager

- Android developer

- iOS developer

- Front-end developer

- Back-end developer

- QA engineer

- UI/UX designers

You will work closely with this team for the next six months (the time may vary depending on the number of team members and your willingness to invest).

App development process: a step-by-step guide

The algorithm for creating a budget application is not very different from making any other. Specificity with emphasis on safety. Otherwise, as always, you need to go through a similar algorithm of actions.

- Market research and analytics

- Development process

- Security

- App design

- Testing and launching

Now a little more detail about each step.

Market research and analytics

First of all, you need to study your target audience. What needs should your proposal cover? What are they waiting for? An analysis of competitors’ financial applications follows from this. What have they not yet managed to offer the public, and what are their strengths? What interesting features can you take on board for yourself, and what weaknesses can you improve? It is important to study the market itself to understand where the industry may move in the future and, as a result, your application.

It is also essential to analyze marketplaces and other advertising spaces to place your personal finance app.

Development process

The technology stack should focus on adaptability, scalability, debugging capabilities, and security. At this stage, experts decide which technology and platform to choose and determine the desired functionality. This phase also includes the technical specifications for creating the application and the product information model. But it’s not just technical nuances that play a role in this step. Business processes need to be modeled as well.

Security

When developing a security system, there is never “too much.” This delicate process should be carried out by real professionals who, among other things, could establish:

- Bank-grade data encryption

- Two-factor authentication

- SSL and HTTPS protocols

- Bio authentication

- Reverse for inactive sessions

This is just a basic package of precautions, you can always discuss additional measures with security experts that would add more security components and, at the same time, will not slow down the operation of the mobile app.

App design

What have we already mentioned several times? Simplicity rules! The clearer you explain complex fintech questions for users, the more likely your budget app will be downloaded.

For example, a familiar hamburger menu, loved by many users, can play a bad joke in this case since it only shows a few functions. There is a chance that the user simply will not see what he needs (although in fact it is) and will leave. Menu bar tabs looks more organic, but there is also a priority issue here.

Speaking of priorities – Priority + Navigation Pattern seems to be the best combination for a financial application. However, only if these very priorities are set as logically as possible, otherwise the venture risks failing. Likewise, a floating button menu can only work profitably if its design is really damn good.

There are also options for gesture-based navigation and full-screen navigation – we do not recommend this. However, this type of design can work with proper design.

Testing and launching

Now it’s time for QA engineers. Before launching a financial application it is important to check the correctness of all calculations, the order of transactions, and test performance. It is important to check the application’s update ability and normal operation in case of complications in functionality.

But security testing is an absolute priority to ensure that personal data is transmitted after encryption and that the data transmission channel is secure. After that, you can move on to production.

To avoid wasting time on cooperation with each freelancer separately, it is better to turn to outsource services where there is already a well-coordinated team of specialists sharpened for the development of such projects as in The App Solutions.

Thus, creating an application like Mint or YNAB will take at least 2,000-2,500 hours of work.

Outcomes

The personal finance app market offers many solutions, but none are perfect. Each of them, offering a certain range of services, chose a specific feature that performed best. This is exactly why people download the application following their needs.

You can still find an unfilled niche and become a leader there. To do this, you need to monitor the market, decide on a concept, draw up a roadmap and contact our company for development. The App Solutions will make an MVP version, gradually adding new useful options, as well as help with project support.

Any interesting thoughts on your mind?

Contact Us